In addition, it is completely free of ads. It is simple and straightforward in its use and still offers you a plethora of cool features that a plain ledger could never do.Īmong the most impressive features that we have come across in Ledgerist, there is definitely the option of repeated transactions for minimizing your effort in handwritten tasks. This pretty neat app has captured the public attention right from the first day of its launch. Start off with the top expense manager app for Android, Ledgerist.

#The best expense tracker app android#

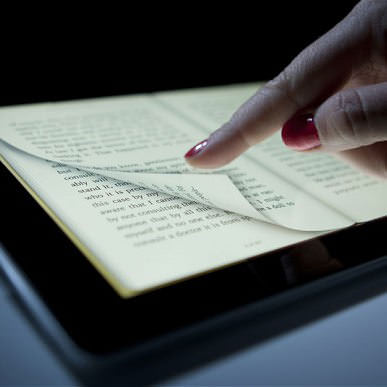

Part 1: Best 5 Android Expense Manager Apps Android expense manager Apps are able to offer you the chance to better handle your finances, since they will keep track of your income and your expenses to the slightest detail. If you have got a lot of bills to pay and you cannot keep track of every single financial transaction, it is always far better to trust some tools that will work true wonders for you and help you sort things out in no time.

:max_bytes(150000):strip_icc()/Rydoo-231fcaf540444d3489cb7b1230b75c78.jpg)

You'll be able to see how much you're spending in different areas each month.

There are several ways that budgeting apps can help you with personal finance: Zeta is widely considered to be the best budget app for couples. These budgeting apps will usually let partners set up both personal and shared accounts. Budgeting apps for couplesĪ budget app for couples is designed for two people to use together. They have tools designed to help you monitor your investment portfolio, review its performance, and make sure you're on track to retire at the age you want. Investment and retirement planning budgeting apps take it a step further, though. Quite a few budgeting apps let you connect your investment accounts and track your net worth. Investment/retirement planning budgeting apps You Need a Budget - YNAB is a popular and highly rated zero-sum budget app. That makes them especially valuable for consumers who are tight on money or trying to pay off debt. Zero-sum budgeting apps are an effective way to see where all your money is going and avoid wasting it. These can be bill payments, savings goals, debt, and everything else you spend money on. The zero-sum system of budgeting involves finding a purpose for every dollar of income you have. Many of the best budgeting apps are based on expense-tracking systems. This is the most popular type of budgeting app. They track your transactions and group them into categories so that you can see where you spend the most. Expense-tracking budgeting appsĮxpense-tracking budgeting apps connect to your financial accounts, such as your bank account and credit card accounts, to help you monitor your spending. This is typically a monthly or a yearly fee, and you can often get a discount if you pay for a year upfront. Paid budgeting appsĪ paid budget app is one that comes with a fee to use. Keep in mind that in many cases, budgeting apps offer both a free version and a premium version with more features. Fortunately, if you're looking for the best free budget app, there are plenty of options available. Free budgeting appsĪ free budget app is one that you can use without needing to pay any sort of monthly or yearly fee. Here are the most common types of budgeting apps you'll find. Just like there are different types of budgeting methods, there are also different types of budgeting apps.

0 kommentar(er)

0 kommentar(er)